Sage 300 Accounts Payable enables you to set up vendor payments terms that you can use to determine which invoices are due for payment processing.

This includes discount date and percentage for early payment.

Payment terms in Sage 300 Accounts payable also includes multiple payment schedule as well as due date tables.

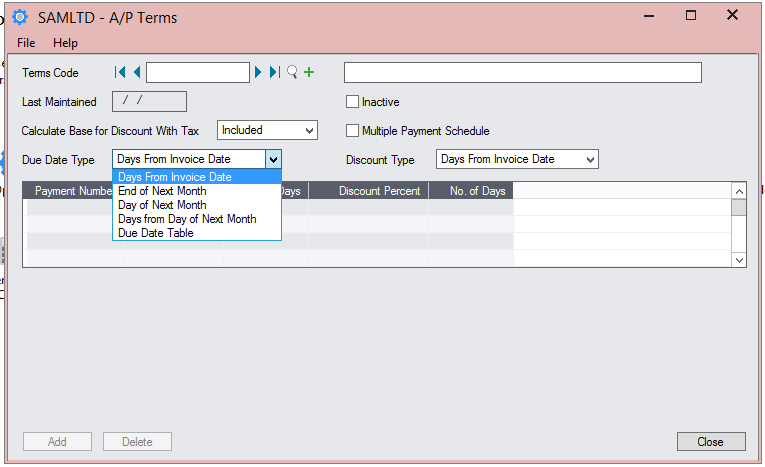

Due Date Type

In Sage 300 Accounts Payable you can select from:

- Days from invoice date

- End of next month

- Day of next month

- Days from day of next month

- Due date table

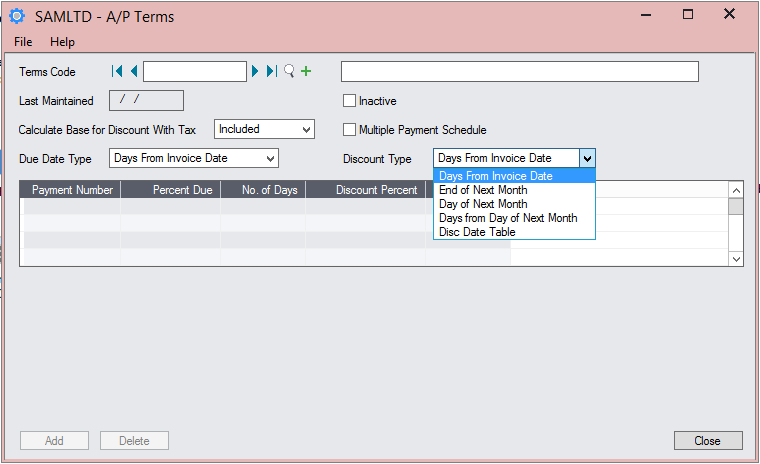

Discount type

Vendor discounts, if applicable have similar options.

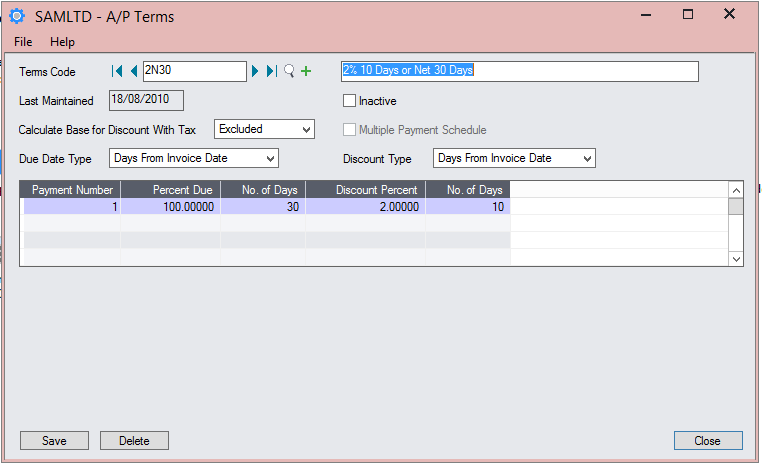

Of the 5, the most commonly used are Days from Invoice Date where you would specify the number of days after the invoice date when payment would be due.

For example:

Here, 100% of the payment is due 30 days from invoice date, but if payment is made within 10 days, you would be entitled to a 2% discount.

If no discount is applicable, enter zero in the Discount Percent column as well as No of Days column.

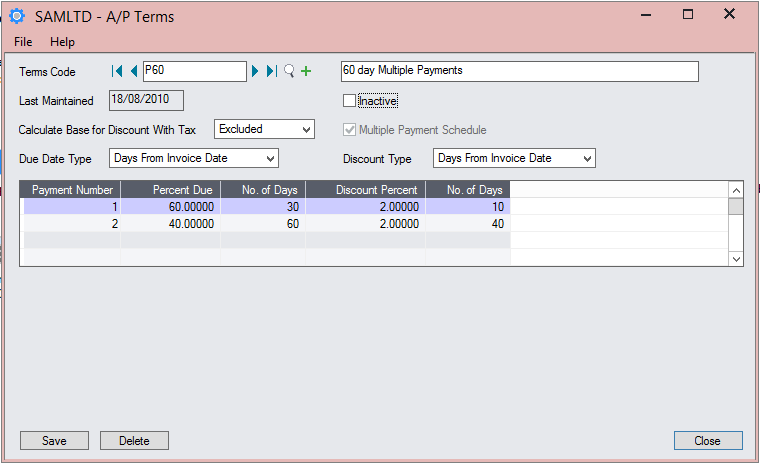

Multiple Payment Schedule

Multiple payment schedule is useful when payments to a vendor are staggered over a period of time.

In the above, the first payment, 60% of the invoice, is due 30 days from date of invoice. The balance of 40% is due 60 days from the date of invoice.