Sage 300 Accounts Receivable module automates your customer billing and collection process from invoice entry to the recording of payments and even to issuing customer refunds.

Accounts Receivable is a feature-rich solution, with tools to help you automate tax calculations, discounts, commissions, and due dates.

It distributes amounts to the appropriate General Ledger accounts for comprehensive cash flow, income statement, and balance sheets.

Powerful enough to manage the most complex processes while maximizing productivity and cash flow, Accounts Receivable gives you the tools you need to collect money as quickly as possible from your customers and improve your Days Sales Outstanding (DSO) ratios.

With a fully integrated solution you get a better sense of short-term profits as well as long-term solvency.

Features

Comprehensive Account Management

Detailed tracking of customer information is vital to keeping your customers loyal.

Using Accounts Receivable and the built-in Sage CRM functionality, you can track every aspect of your customer.

With the comprehensive information available to your accounting, finance, and mobile sales staff, answering customer inquiries is a snap.

Add on the National Accounts Management functionality and you can use Accounts Receivable to process a single payment from a customer’s head office and apply it to multiple subsidiary accounts.

National accounts also lets you limit the amount of credit you extend to a company in one step.

Accurate Processing

The number-one way to lower costs and speed up collections is to speed up paperwork wherever possible.

With Accounts Receivable you can significantly speed up invoice processing and receipts.

Set up extensive credit options that offer your customers the incentives they need to pay sooner, or let them pay by credit card and easily track preauthorized payments.

You can also import transactions from other applications and seamlessly connect with EDI by TrueCommerce.

Or quickly create summary or detailed invoices using the item price list and calculate taxes on a summary or line-by-line basis.

Assign invoice or memo numbers automatically or manually and instantly verify unapplied payments, credit limits, and past-due amounts.

You can also create adjustment batches automatically to write off small account or transaction balances and choose whether to charge interest on overdue balances or individual invoices.

Schedule any number of recurring charge invoices for fast invoicing of monthly charges, and update recurring charges automatically by amount or percentage.

Seamless Connectivity

Accounts Receivable eliminates redundant entry efforts by automatically updating General Ledger journal entry batches, and you can specify which transaction details flow to the General Ledger, Bank Services with check receipts, and Sage CRM with all customer and invoice information.

Easily bill Project and Job Costing Fixed Price projects using a summary or item invoice.

Better yet, Sage 300 includes a Sage CRM user at no additional cost.

Sage CRM ensures your sales, marketing, and customer services resources are being used to maximum effect—even when they are on the road, as mobile functionality is built in.

With this fully integrated solution you have access to a powerful collections process so you can improve your Days Sales Outstanding ratio.

Multicurrency Capabilities

Take control of the global marketplace with robust multicurrency capabilities, including instant conversion of foreign currencies to home currency and vice versa and calculation of gains and losses accrued through currency exchange.

Providing invoices and statements in your customers’ currency makes it easy and convenient for them to do business with you.

Using Accounts Receivable with the Multi-Currency Manager module empowers you to transcend many of the operational challenges of global enterprise.

Comprehensive Analysis

You can easily monitor, review, and reprint customer invoice and credit note transactions, orders, invoices, and credit notes by primary salesperson.

Extensive reporting and inquiry capabilities provide the insights you need to provide the best possible price to your customers and ensure the best possible delivery date.

Easy accessible information equips your sales team with the big-picture insights into which items they should cross-sell or up-sell to their customers.

The Inquiry tool also provides the ability to create quick and easy ad-hoc queries on accounts receivable data.

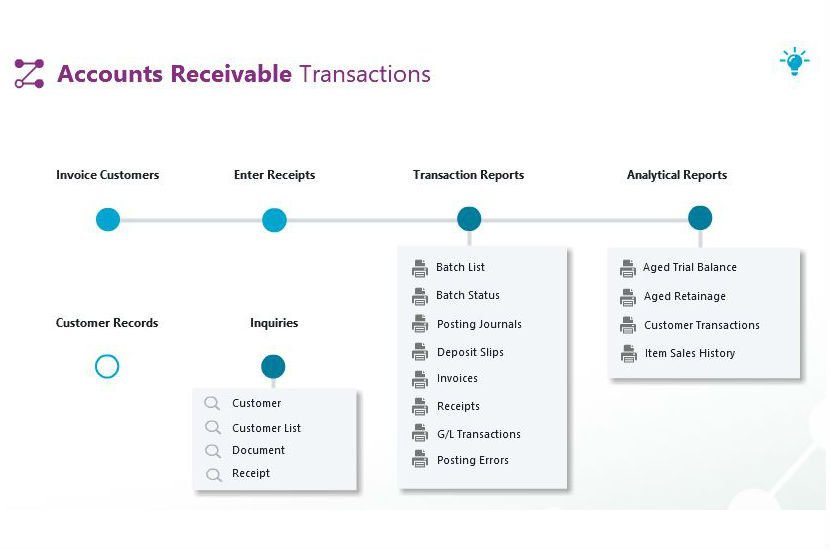

Standard report examples:

- Aged Trial Balance,

- Customer Transactions,

- Deposit Slips,

- Item Sales History,

- and more.