This article relates to the Goods & Services Tax (GST) which was introduced in April 2015, but was subsequently replaced with the Sales & Service Tax in September 2018.

The Ministry of Finance Malaysia has stipulated that Goods & Services Tax (GST ) be zero-rated from 1st June 2018.

Sage 300 users can adjust the GST rate from 6% to 0% as follows: (Note: Please see update below)

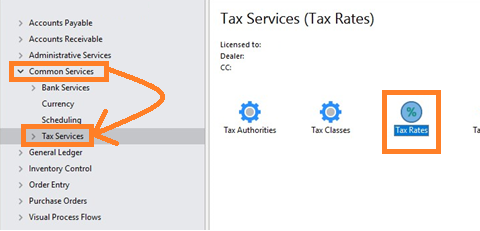

Tax rates in Common Services

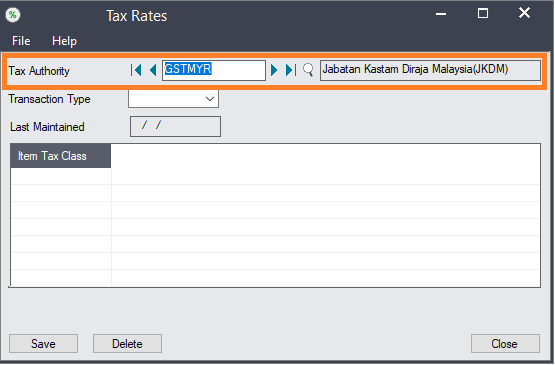

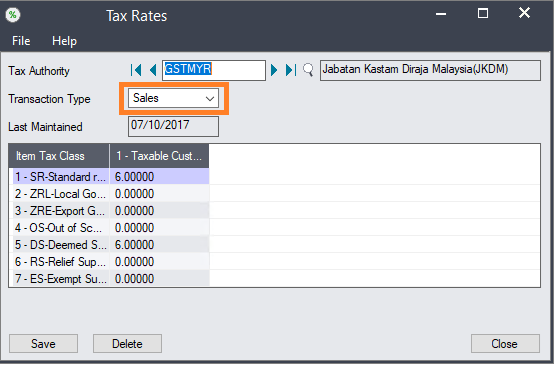

Updating Sales GST tax rate

Edit the rate by double clicking inside the rate column of the SR- Standard rated row and changing the rate from 6.00000 to 0.00000

Click the Save button to save the changes.

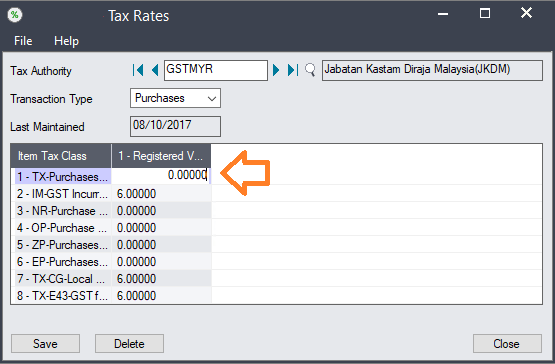

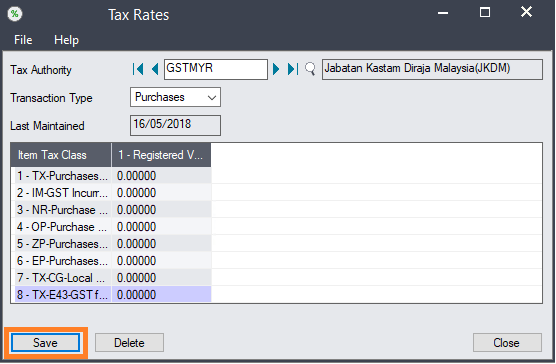

Updating Purchases GST tax rate

Edit the rate by double clicking inside the rate column of the TX-Purchases rated row and changing the rate from 6.00000 to 0.00000.

Repeat for all the other Tax Classes.

Update

To maintain both old (GST at 6%) and new (GST at 0%) tax information in Sage 300, it is advisable to create a new set of tax settings.

- Add a new Tax Authority, for example “GST0”, that you can use from 1st June 2018.

- Define the same tax classes as you did earlier for GST at 6%

- Instead of 6%, set all tax rates to 0%

- Setup Tax Groups to point to the new Tax Authority

- Perform the tax mapping as you did previously.