LHDN has announced that e-invoicing will be implemented in phases starting from June 2024.

What is e-Invoicing?

An e-invoice is an invoice generated in a specific, standardised format, and involves creating, sending as well as receiving invoices electronically.

It facilitates the automated exchange of invoices between businesses and organisations in a structured digital format.

The structure of the digital format for e-invoice should be in either XML or JSON format which will be provided by LHDN.

This will facilitate the exchange of data between organisations regardless of the accounting system they use.

Objective of e-Invoicing

Following the signing of an MOU between LHDN and MDEC in October 2022, MDEC states the objective of this initiative as

The National E-Invoicing Initiative aims to drive interoperable E-Invoicing by digitalising how businesses send invoices to other businesses, allowing different accounting software and Enterprise Resource Planning (ERP) system to send and receive e-invoices in a system-to-system manner.

Timeline for implementation

e-Invoicing will be implemented in phases starting from June 2024.

Implementation is based on annual turnover starting with businesses having annual revenue of RM100 million or more.

Phase 1

June 2024

Mandatory for businesses with annual revenue of RM100 million or over.

Phase 2

January 2025

Mandatory for businesses with annual revenue of RM50 million or over.

Phase 3

January 2026

Mandatory for businesses with annual revenue of RM25 million or over.

Phase 4

January 2027

Mandatory for ALL businesses.

Update

In October 2023, LHDN has revised the implementation timelines to:

August 2024

Mandatory for businesses with RM100m turnover or more

January 2025

Mandatory for businesses with turnover of RM25m or more.

July 2025

Mandatory for ALL businesses.

Update:

This phase is mandatory for businesses with an annual turnover of RM150,000.00 or more.

Businesses with annual turnover of RM150,000.00 or less have been exempted.

Voluntary implementation

Businesses that do not fall in the above revenue threshold categories can voluntarily participate in the implementation from January 2024 onwards.

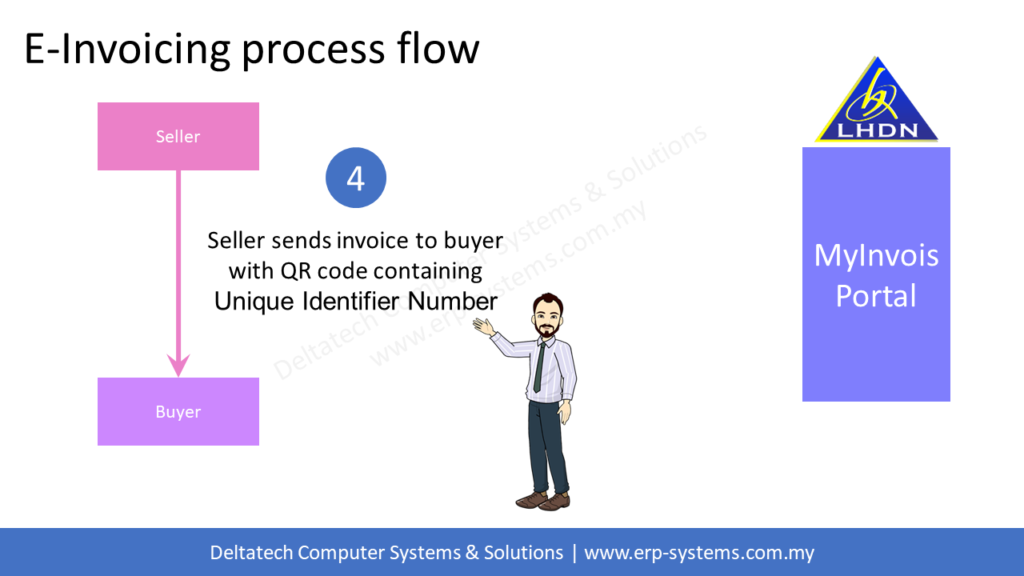

Process flow

When a supplier issues an invoice, credit note or debit note, it first needs to be submitted to LHDN for validation via their portal

Once the invoice has been validated, LHDN will provide a Unique Identifier Number for the document.

The supplier then needs to embed this Unique Identifier Number, in the form of a QR code on the invoice before forwarding it to their customer.

Note that at this point, the status of the invoice will be pending.

The customer then has the option to either accept or reject the invoice within 72 hours.

If the customer does not accept the invoice, then the status will be changed to approved.

If the customer rejects the invoice, they need to provide a reason, and the seller will be notified, and can resubmit an amended invoice.

If the invoice is rejected after approval, then the seller will need to issue a credit note to cancel it.

The credit note will need to go through the same process as the invoice, submit to LHDN for validation, get a Unique Identifier Number, and forward to the customer.

With the implementation of e-invoicing, buyers will only be able to claim an expense if it is supported with an invoice that has been validated through the portal and has a valid QR code.

How to submit?

LHDN has provided two methods of transmitting e-invoices:

- By accessing the MyInvois Portal directly

Enables generating a single invoice by completing and submitting a form.

You will also be able to process multiple transactions by uploading a spreadsheet.

However, this medium of submission is more suited to smaller business that only have a few invoices to process. - Application Programming Interface (API)

Enables the direct communication with LHDN’s portal by an application such as Sage 300 to submit one or more invoices.

Bigger businesses will find this method more efficient and less time consuming as the application will do the submission when the invoice is issued.

Tax Identification Number (TIN)

In both cases, you will require a digital certificate that would need to be incorporated with the submission.

The digital certificate is issued by LHDN and will have an initial validity period of three (3) years.

The TIN is included in the digital certificate along with other relevant business information.

You can either check your TIN or register your business for one by visiting MyTax portal.

Sage 300 e-Invoicing functionality

LHDN will be releasing the API SDK in the last quarter of this 2023.

Sage will be developing the integration with LHDN’s portal using this SDK to provide real time submission of invoices that are issued, as well as keep track of notifications regarding the validation or rejection of it.

Initially, the feature will be developed for the Order Entry module.

Do note that this will only be available for the 2023 version onwards.

If you are using versions before 2023, it is advisable to upgrade to assure seamless compliance with the e-Invoice requirements.

Updates & Announcements

[catlist id=26 excludeposts=”this”]

Feature spotlights

[catlist id=5]