Webinar

How to better manage receivables and cash flow during this crisis

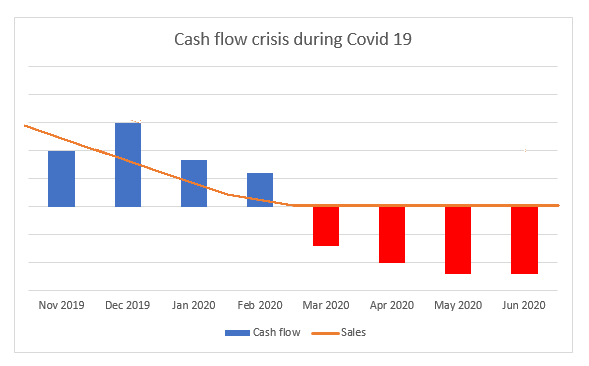

Covid 19 directly affects business continuity as business operations reduce, supply chains dry up, and demand plunges. Sales flatten out, cash flow goes into negative.

It is important that businesses are proactive in assessing their risk and vulnerability from both an operational and a financial standpoint.

Traditional methods of aging receivables and forecasting cash flow are no longer applicable and do not provide actionable information.

Cash management and identifying short term action plans are especially critical now. Business owners need to adapt to the “new” ways of business.

New requirements such as managing EXTENDED payment due date, managing by key customer accounts, etc is required but can be very time consuming and tedious if done manually.

We understand the importance of these challenges faced by businesses today.

Join us for a free 45 minute webinar where we will highlight and help to address these challenging issues:

- Cash management & control

- How receivables collection forecasts help

- Understand accounting software limitations when managing receivables forecast.

- Managing extended receivables forecast

- What to lookout, What are the Dos and don’ts.

August 2020

Registrations are closed

If you are interested in attending future webinars, please submit your details here and we will keep you updated.

Yes, I wish to attend future webinars

This is the first in our series of webinars that we are organising to help businesses face the challenges of the Covid 19 lock down.

Most importantly, Stay Safe.