Norming’s Asset Accounting module provides the basic functionality for processing asset accounting transactions, including acquisition, depreciation, adjustment, disposal and impairment.

Features:

- Integrates with Sage 300 G/L, A/P, A/R, I/C, P/O and PJC.

- Provides unlimited optional fields for asset register and transaction detail.

- Provides flexible asset and barcode numbering.

- Manage the asset construction progress.

- Multi-currency support.

- Comprehensive inquiry and reporting functionality.

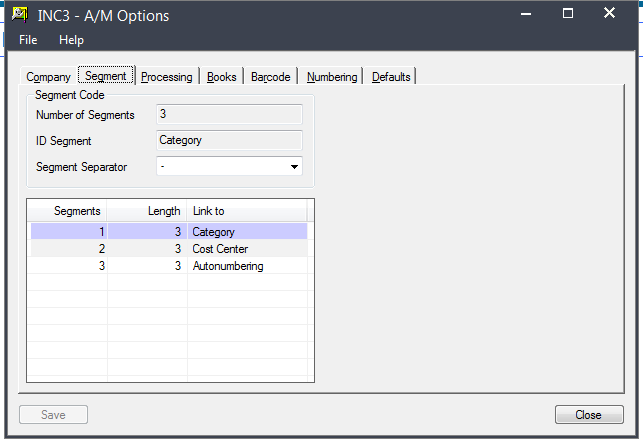

Asset numbering

- Asset ID can consist of up to 72 characters with up to 9 segments

- Each segment can use the segment code of category, cost center, location, and group.

- Auto numbering facility is also available.

Asset Acquisition

- Converts PJC transactions to assets.

- Converts P/O receipts or invoices to assets.

- Converts I/C internal usage to assets.

- Converts A/P invoice to acquisition entry.

- Creates A/P invoice or Misc. payment from acquisition batch.

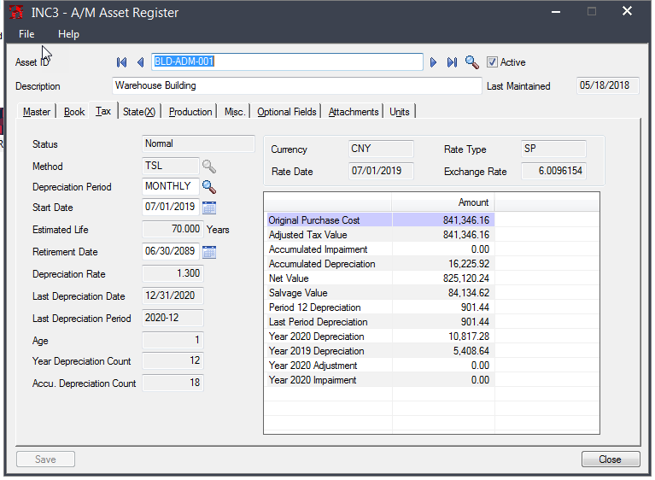

Asset Depreciation

- Provides up to 5 books for tracking asset depreciation.

- Runs depreciation for a range of assets for any number of periods.

- Depreciation calculation uses standard or user-defined formula.

- Depreciation Projection facilitates financial planning.

- The depreciation can be reversed to any period of past years.

Asset Impairment

- Impairment can be captured to comply with IFRS and GAAP principles.

- Impairment reversal is enabled

Asset Adjustment

- Changes asset value or salvage value.

- Changes asset year depreciation.

- Transfers assets between cost centers, locations, etc.

- Changes asset life, depreciation method and rate.

Asset Disposal

- Disposes asset at user-specified proceeds with user-defined proceeds account.

- Creates A/R invoice or I/C receipt for asset disposal batch.

- Bulk disposal is enabled.

- Partial disposal is enabled.

- Disposal transaction can be reversed.

Merge or Split Assets

- One asset can be split to multiple assets.

- Multiple assets can be merged to one asset.

Comprehensive Inquiry and Reporting features

- Search asset by category, group, cost center, location

- Review complete asset activities history and the original transaction entry.

- Check component assets of master asset.

- Maintain serial no. and bar-coding for each unit of asset.

- Print standard or customized label for each unit of asset.

- Print asset list, asset history and depreciation report for audit or reconciliation with G/L.

- Print depreciation projection report for the financial planning.

- Print capitalization analysis to compare budget with expenditure.

Integration

Norming Asset Accounting integrates with the following modules:

- General Ledger,

- Accounts Payable,

- Accounts Receivable,

- Inventory Control,

- Purchase Order, and,

- Project and Job Costing