Streamline Sage 300 payments & receipts using Orchid Systems EFT Processing module.

EFT Processing is developed in the Sage 300 SDK, providing the familiar Sage 300 look and feel plus standard security, customization capabilities, data integrity checking and more.

EFT Processing stores all data within Sage 300 and integrates seamlessly with Accounts Payable and Accounts Receivable.

Why EFT processing?

- Increased automation means improved efficiency, greater accuracy, lower costs

- Save time and reduce errors by avoiding duplicate data entry

- Numerous security features, including audit-logging and encryption of bank account details

- Have confidence that your cash movements are secure, and would stand up to an audit

- Hundreds of bank formats already supported, others created on request

- Reduce exposure to fraud by moving away from paper cheques or streamlining positive pay file processing

- Reduced bank transaction fees

- No more expensive paper cheque stationery

- Reduced printing, handling and postage costs

- Automatic EFT file creation avoids duplicate data entry

EFT Processing features

EFT File Creation

EFT Processing automatically creates EFT files in the format required by your bank, for both payments and receipts:

- Creates EFT Payment files based on the standard Sage 300 processing routines, i.e. Accounts Payable Payments and Accounts Receivable Customer Refunds

- Creates EFT Direct Debit files based on the standard Sage 300 Accounts Receivable receipt processing routine

- Optionally, when generating bank files it lets you elect to skip or error on Vendors or Customers who are not defined in EFT Processing

- Summary transaction logs are created

Bank File Formats supported:

- EFT Processing already supports formats for hundreds of banks, in many countries around the world

- Supports user-definable bank formats

- Orchid Systems are frequently adding new formats, or updating existing ones

- If the format you need is not currently supported it can be created by Orchid Systems upon request

Remittance Advice and Processing Options

- Remittance Advices can be emailed, using standard Sage 300 functionality, to EFT-specific Customer or Vendor email addresses

- Outbound emails can be throttled or capped to cater for email platform restrictions

- Can be configured to work with posted or unposted batches

- Configure to select from a range of batches, pay period end dates, or selected entries

Security Features

- Changes to Vendor or Customer bank account details require a 2-step approval process

- Extensive Audit logs of changes and transactions created

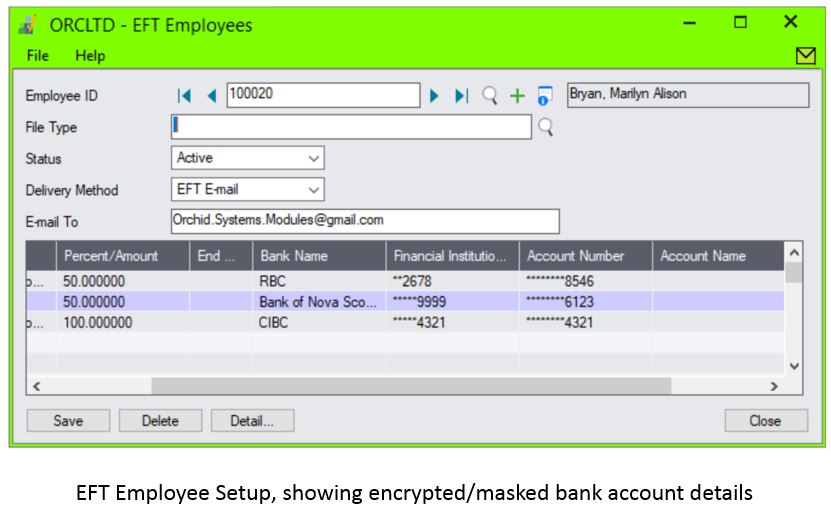

- Bank Branch Code and Account Numbers stored in your database can be encrypted – users will only see a masked version of the numbers

- Optional protection of emailed Remittance Advices using a formula-driven password

- Periodic processing task to delete inactive records

- EFT details are cleaned out when the associated Vendor or Customer is deleted

Maintain Bank Details

- EFT Processing Accounts Payable and Accounts Receivable holds banking details for Vendors and Customers

- Provides a warning if duplicate EFT bank branch codes or accounts are entered for Vendors or Customers

- Supports user-definable screen labels to reflect bank terminology

- Optionally stores Vendor bank account details by remit-to code

EFT Processing supports Customer Number Change and Vendor Number Change.

EFT Processing Minimum Requirements

EFT Processing for Accounts Payable & Accounts Receivable requires Sage 300 Accounts Receivable and/or Accounts Payable